|

Date |

Article

Articles

are added weekly

|

Source

|

Comment

|

|

01/27/23

|

The tangled web to deceive

|

Living Lies |

The tangled web to deceive

-

The cancer that keeps eating away at the foundation of our economy is the current culture on Wall Street. It involves fake accounts, fake documents, and nonexistent transactions.

-

It involves lawyers who are protected by litigation immunity and who promote false claims on behalf of claimants that have not hired them or even know they exist. We have seen such nonsense multiple times in history. It always ends the same —- with a crash. And apparently, the 2008 crash wasn’t enough because they are still doing it.

-

With a hit tip to summer chic, here is an edited version of what she recently wrote to me.

-

Lone Star reincarnated Countrywide into Caliber and BlackRock – into PennyMac

-

There are at least 10-12 companies preying on each of us at any given time.

-

Elle correctly said – investment banks are not involved in extortion from homeowners – directly. This is probably why Wells is “leaving housing market”

-

They act via numerous intermediaries- hedge funds and fintech who in turn act via fake servicers and fake lenders.

-

That is what Wall Street does – they establish the Scheme to sell securities.

-

Then they destroy all documents about their transactions – after it was imaged and stored in Foley’s database ; and declare it “defaulted”

-

Each prior transaction is stored in this database as defaulted.

-

As many times as the property was sold, refinanced or modified , each time it creates a new string of securities- and this new transaction is named as “defaulted” right away and assigned to so-called “debt buyers” who of course did not buy anything and do not own anyone’s debt.

-

The largest “debt buyer” is BlackRock, who merely is given access to Black Knight’s database and permission to steal as much as they can from homeowners under cover up of “servicers” who merely rent their names for correspondence and “billing statements “

-

Hedge funds also don’t have access to money flow since it’s all done via BL, Fiserv and Exela.

-

Each hedge fund has its own cohort of smaller fintech companies who receive passwords and instructions from main Fintech such as Bkack Knight and Fiserv.

-

The players get paid by Wall Street banks after money is transferred offshore.

-

All details should be investigated by DOJ who of course knows about it.

|

|

01/26/23

|

Script for Tongue-tied pro se litigants and lawyers

|

Living Lies |

Script for Tongue-tied pro se litigants and lawyers

A simple truth always applies: Only an experienced trial lawyer can walk into a courtroom and feel comfortable. Everyone else is angry, confused, or terrified, even if they are a lawyer. The consequence is that they either say nothing at all or say nothing that is relevant or persuasive, or both.

|

|

01/25/23

|

CFPB Takes Action to Halt Debt Collection Mill From Bombarding Consumers with Junk Lawsuits

|

Living Lies |

CFPB Takes Action to Halt Debt Collection Mill From Bombarding Consumers with Junk Lawsuits

CFPB Takes Action to Halt Debt Collection Mill From Bombarding Consumers with Junk Lawsuits

Forster & Garbus illegally sued borrowers on behalf of Citibank and Discover, among others

|

|

01/24/23

|

Fannie Mae and Freddie Mac Announce Major Changes to Mortgage Financing

|

Huntsville Business Journal |

Fannie Mae and Freddie Mac Announce Major Changes to Mortgage Financing

New mortgage financing policies from Fannie Mae and Freddie Mac are poised to shake up the housing market for 2023.

Loan Level Price Adjustments (LLPAs) are determined by a number of factors, most prominently the borrower’s credit score and debt-to-income ratio (DTI), among others.

The new policies concerning LLPAs will reduce the cost incurred for having a lower credit score. There will still be a discrepancy between lower credit and higher credit scores, just not quite so punishing of one.

These changes will come into effect for loans guaranteed by Fannie Mae or Freddie Mac, starting on May 1, 2023. While these changes will apply to the majority of loans within the United States, there are some, such as VA loans or “jumbo loans” from credit unions, that will be exempt from these changes.

|

|

01/24/23

|

I’m fighting against homeowners who think they know

|

Living Lies |

I’m fighting against homeowners who think they know

Here is an example from one of my more savvy readers who still makes the key error: This person refers to the “Depositor” in the chain of “Securitization” references contained in various documents. None of those entries are legally significant in any way unless they (refer to real-world transactions ) and (b) are contested by homeowners.

|

|

01/23/23

|

How to Speak to the Judge

|

Living Lies |

How to Speak to the Judge

I obviously cannot compact 47 years of courtroom experience into a single article or, for that matter, any less time than I spent in courtrooms, conducting thousands of hearings and trials. But I can distill what I think made me successful (most of the time). So I have decided to start suggesting things that pro se homeowners and/or their lawyers should start saying in court — using their own styles and their own feel (“the vibes”) of the judge and the courtroom.

|

|

01/20/23

|

Don’t get lost in the weeds!

|

Living Lies |

Don’t get lost in the weeds!

Anyone who watches the Madoff Ponzi documentaries knows that people deluded themselves out of greed. The basis of the Madoff scheme was a huge pile of documentation that was all fake. The “business” was taking money from investors and investing it. Madoff never made a single transction.

There was no such business. This is what happened and what is still happening with “loans” that are originated by investment banks though multiple layers of intermediaries. There is no loan business. There is only the business of selling securities. And in doing that, there is no balance due.

Millions of homeowners and thousands of lawyers have become lost in the weeds as they overlook the most obvious question: did this transction ever produce an unpaid obligation from the homeowner? Was that obligation ever purchased and sold in a transction between any assignor and assignee or endorser and endorsee?

The answer is simply NO! So why do homeowners and their lawyers inisist on paying it?

|

|

01/20/23

|

Were You a Wells Fargo Customer Over Last Decade? You Could Be Entitled to Thousands in Damages

|

Yahoo Finance |

Were You a Wells Fargo Customer Over Last Decade? You Could Be Entitled to Thousands in Damages

More than 16 million people are owed some serious cash from Wells Fargo. If you happened to be a customer of the banking institution during the period of 2011 to 2022, this could apply to you, according to CNBC.

|

|

01/19/23

|

What You Need to Know About Foreclosure Rates

|

US News |

What You Need to Know About Foreclosure Rates

As a homeowner, homebuyer or aspiring real estate investor, you want to understand the housing market more. Median home prices, mortgage interest rates and average days on market are all valuable metrics to grasping current activity on the market.

But how homeowners are able to hold onto their existing properties is just as important.

|

|

01/19/23

|

Wells Fargo might owe you money—here’s how to get it

|

CNBC |

Wells Fargo might owe you money—here’s how to get it

If you had a Wells Fargo account between 2011 and 2022, you might be one of the 16 million customers who qualify for damages, says the Consumer Financial Protection Bureau (CFPB).

As part of a $3.7 billion settlement, Wells Fargo has agreed to pay more than $2 billion directly to customers harmed by “illegal activity,” ranging from incorrect overdraft fees to wrongful foreclosures, according to the CFPB.

|

|

01/19/23

|

Did You Ever Wonder What It Takes to Enjoin a Foreclosure Sale?

|

DSNews |

Did You Ever Wonder What It Takes to Enjoin a Foreclosure Sale?

With inflation on the rise and the economy slowing, foreclosures are unfortunately likely to increase. With more foreclosures, there will likely be a rise in borrowers’ suing at the last minute to stop the foreclosure.

In fact, our firm has already started to see a substantial uptick in requests for the court to issue a Temporary Restraining Order (TRO) to stop an impending foreclosure sale. Since the requirements to obtain a TRO differ in every state, this article will help loan servicers and investors (collectively, “lenders”) understand the varying TRO processes.

|

|

01/19/23

|

EVERYONE LIES IN THE MARKETPLACE — THE GOVERNMENT IS NOT DOING ITS JOB

|

Living Lies |

EVERYONE LIES IN THE MARKETPLACE — THE GOVERNMENT IS NOT DOING ITS JOB

The basis for most big business plans is to give the consumer the worst possible product or service while convincing the same consumer that the cost is inevitable and the product or service is excellent. This produces something that Alejandro Reyes of Deutsch Bank called a “counter-intuitive” system. This term has been widely adopted, even if not accurate. It basically another word for lying.

|

|

01/19/23

|

In 16 Years, the Fed Has Approved 4,506 Bank Mergers and Denied One

|

Wall Street On Parade |

In 16 Years, the Fed Has Approved 4,506 Bank Mergers and Denied One

On Tuesday, Jerome Powell’s Federal Reserve once again thumbed its nose at President Biden’s antitrust directive regarding the creation of more mega banks through merger. This time around, the Fed allowed the Bank of Montreal, with assets of $834 billion, and its subsidiary, BMO Financial, to gobble up Bank of the West, based in San Francisco. Following the merger, Bank of the West is to be merged into Bank of Montreal’s subsidiary bank, BMO Harris Bank.

|

|

01/18/23

|

CFPB says servicers should offer loss mitigation beyond COVID hardships

|

American Banker |

CFPB says servicers should offer loss mitigation beyond COVID hardships

The Consumer Financial Protection Bureau said it expects mortgage servicers to continue offering forbearances, deferrals and loan modifications to consumers experiencing financial hardships unrelated to the COVID-19 pandemic.

|

|

01/18/23

|

Four Crypto-Friendly Banks Are Being Bailed Out with Billions from a Federal Housing Program

|

Wall Street On Parade |

Four Crypto-Friendly Banks Are Being Bailed Out with Billions from a Federal Housing Program

Remember those Fed bailouts of the mega banks on Wall Street during and after the 2008 financial crisis that the Federal Reserve battled in court for years to keep secret from the American people? Those bailouts went to the same Wall Street mega banks that collapsed the U.S. economy with their unbridled greed and unchecked corruption. The banks were even allowed to pay big bonuses to their execs with the bailout funds.

When Senator Bernie Sanders forced the bailout details into the sunlight with a mandated government audit, the findings were so revolting that Senator Sanders had this to say:

|

|

01/18/23

|

FIRST DEFINE YOUR TERMS

|

Living Lies |

FIRST DEFINE YOUR TERMS

Plato said (maybe it was Aristotle), first, define your terms. Unless you use the terms correctly- and not just the way you want to use them- you will not make sense in any court. As soon as you open your mouth, you will be revealing that you either don’t know or don’t care about the rule of law. And as soon as you do that, you are inviting the judge to give no weight to your argument or evidence. It’s not up to the judge to clarify what you are trying to say.

|

|

01/17/23

|

FOIA Requests Reveal the Truth About JPMC-WAMU “Purchase”

|

Living Lies |

FOIA Requests Reveal the Truth About JPMC-WAMU “Purchase”

The bottom line is that JPM Chase did not actual purchase or pay for anything. The net “price” was negative including an IRS refund due to WAMU but transferred to JPMC.JPMC did acquire the book value assets and liabilities of WAMU and subsidiaries, but there was was litttle in the way of book value for assets which would have included loans — if there were any “loans” (debts+notes + mortgage liens) that were owned by WAMU at the time of its collapse..

|

|

01/16/23

|

A Perfectly Good Deed Can Result in a Perfectly Bad Title

|

Living Lies |

A Perfectly Good Deed Can Result in a Perfectly Bad Title

In an article by New Jersey attorney Dennis M. Gonski | Updated on March 18, 2009, the qualities of “real title” are clearly specified. His “wild deed” commentary applies equally well to promises of title or implied promises of title to liens.

My point in directing your attention to this article is that Gonski takes on the most popular misconception: that the paper instrument is the event. If that were true, the Brooklyn Bridge would belong to thousands of people.

|

|

01/13/23

|

Wells Fargo suffered 50% profit loss during the fourth quarter

|

FOX Business |

Wells Fargo suffered 50% profit loss during the fourth quarter

Following Wells Fargo's $3 billion penalty over a financial scandal, the bank reported a 50% loss in profit for the fourth quarter.

News of the profit drop affected Wells Fargo's remarket stock, which fell by 4% Friday morning.

The bank's quarterly earnings report indicated a 67-cent per-share profit for Dec. 31, which is significantly behind the $1.38 per share from the same period last year.

|

|

01/13/23

|

MD Adopts Changes to Residential Foreclosure Procedures

|

JDSUPRA |

MD Adopts Changes to Residential Foreclosure Procedures

Maryland recently adopted what it characterizes as nonsubstantive changes to clarify previous regulatory amendments (adopted July 22, 2022) regarding foreclosure procedures for residential property. The adopted regulatory amendments, including these recent changes, are effective March 1, 2023.

|

|

01/13/23

|

The Case for Discipline of Attorney Who Present False Claims in Support of Foreclosure

|

Living Lies |

The Case for Discipline of Attorney Who Present False Claims in Support of Foreclosure

Lawyers are not permitted to make up claims and file lawsuits or other processes to seek a remedy. They must be representing a client who is the owner of the claim. In foreclosure, this is not the case. Wall Street has weaponized the necessary standard protections for lawyers into a vehicle for promoting false claims.

|

|

01/12/23

|

U.S. Foreclosure Activity Doubles Annually But Still Below Pre-Pandemic Levels

|

Atom Data |

U.S. Foreclosure Activity Doubles Annually But Still Below Pre-Pandemic Levels

IRVINE, Calif. – Jan. 12, 2023 — ATTOM, a leading curator of real estate data nationwide for land and property data, today released its Year-End 2022 U.S. Foreclosure Market Report, which shows foreclosure filings— default notices, scheduled auctions and bank repossessions — were reported on 324,237 U.S. properties in 2022, up 115 percent from 2021 but down 34 percent from 2019, before the pandemic shook up the market. Foreclosure filings in 2022 were also down 89 percent from a peak of nearly 2.9 million in 2010.

|

|

01/12/23

|

Beware Motion for Substitutions of Trustees, Plaintiffs and Credit Bidders!

|

Living Lies |

Beware Motion for Substitutions of Trustees, Plaintiffs and Credit Bidders!

By laundering the title to the recorded lien AFTER the homeowner has failed to derail the false claim, the foreclosure mills have lulled most homeowners and most lawyers and judges into a state of complacency wherein they miss the fact that the new substitution — often without permission of the court — is an admission that the homeowner’s defense narrative was correct from the beginning.

|

|

01/11/23

|

CFPB Proposes Rule to Establish Public Registry of Terms and Conditions in Form Contracts That Claim to Waive or Limit Consumer Rights and Protections

|

Living Lies |

CFPB Proposes Rule to Establish Public Registry of Terms and Conditions in Form Contracts That Claim to Waive or Limit Consumer Rights and Protections

CFPB Proposes Rule to Establish Public Registry of Terms and Conditions in Form Contracts That Claim to Waive or Limit Consumer Rights and Protections

|

|

01/11/23

|

Katherine Ann Porter, champion of homeowners and consumers, is running for Senate. If you care about foreclosure fraud you should support her bid for Senate

|

Living Lies |

Katherine Ann Porter, champion of homeowners and consumers, is running for Senate. If you care about foreclosure fraud you should support her bid for Senate

It is no exaggeration that Katie Porter is why this blog started. While at the University of Iowa, she conducted a study with startling revelations. The discovery that original promissory notes were destroyed most of the time made it possible for thousands of homeowners to defend their homes from false claims seeking foreclosure successfully.

|

|

01/10/23

|

Wells Fargo, once the No. 1 player in mortgages, is stepping back from the housing market

|

CNBC |

Wells Fargo, once the No. 1 player in mortgages, is stepping back from the housing market

Wells Fargo

is stepping back from the multitrillion-dollar market for U.S. mortgages amid regulatory pressure and the impact of higher interest rates.

Instead of its previous goal of reaching as many Americans as possible, the company will now focus on home loans for existing bank and wealth management customers and borrowers in minority communities, CNBC has learned.

|

|

01/10/23

|

KEEP IT SIMPLE. DON’T GET LOST IN THE WEEDS

|

Living Lies |

KEEP IT SIMPLE. DON’T GET LOST IN THE WEEDS

The practice hint for all this is NOT to trace all the layers and steps. The question in the case at bar in every foreclosure is whether there is an identified claimant with a claim based on the existence of an unpaid loan account (collateral account) on its own ledgers

|

|

01/09/23

|

Paatalo: If you don’t think judges will listen, think again

|

Living Lies |

Paatalo: If you don’t think judges will listen, think again

Skeptics often confront me to say that judges refuse to listen to their arguments.

My response is always the same.

But nobody likes the answer.

Judges will listen if you have something relevant to say, and you are saying it in proper form and in a timely manner. Both homeowners and lawyers fail to present appropriate arguments because they insist on admitting to the existence of a nonexistent debt. The rest is a “yes, but” defense that rarely produces anything other than frustration.

|

|

01/09/23

|

Banking Lesson to Aid Homeowners in Discovery or Statutory Demand Letters

|

Living Lies |

Banking Lesson to Aid Homeowners in Discovery or Statutory Demand Letters

Homeowners and their lawyers look at a canceled check and understandably and reasonably come to an erroneous conclusion. They think the check shows who physically received the check, who deposited it into a depository account, and who owns that account.

|

tr>

01/09/23

|

What new supervised institutions need to know about working with the CFPB

|

CFPB |

What new supervised institutions need to know about working with the CFPB

While the CFPB has longstanding supervisory relationships with many institutions, we also conduct exams or other supervisory activities at companies for the first time. Here’s what newly supervised institutions can expect from a supervisory relationship with the CFPB.

|

|

01/09/23

|

New York Enacts Retroactive Foreclosure Legislation

|

JDSUPRA |

New York Enacts Retroactive Foreclosure Legislation

While many around the world are setting their calendars forward for the year 2023, residential mortgage loan owners and servicers may need to also look backward in time now that New York Governor Kathy Hochul signed the so-called “Foreclosure Abuse Prevention Act” (S5473) into law on December 30, 2022. The new law, which takes effect immediately, threatens to significantly constrain the ability of lenders, servicers and investors to efficiently prosecute foreclosure actions and potentially jeopardizes their ability to recover their mortgage debt with respect to not only foreclosures initiated after the law took effect but also foreclosure actions which were pending as of December 30.

|

|

01/08/23

|

Then Again: After the Revolution, debt crisis triggered extreme unrest

|

VT Digger |

Then Again: After the Revolution, debt crisis triggered extreme unrest

The end of the American Revolution brought Americans peace. But prosperity? Not so much.

Waging and winning a war with Britain had run the new nation heavily into debt. Worse yet, Britain seemed to take the whole business of losing rather poorly, and continued the conflict by inflicting economic pain on its former colonies. The British cut off American access to important markets in the West Indies, which would have helped the new country pay off its debts.

People felt the separation from Britain keenly when they tried to settle their own debts. When the British left, so did easy access to British coinage, which is what creditors demanded for repayment. They weren’t interested in bartering for goods or accepting paper money issued by the various state governments, because those notes were worth just a fraction of their face value. Therefore, many people faced debts they had no way of repaying.

Actually, courts ruled they still had one way to pay: Judges regularly intervened and foreclosed on debtors’ property.

From the creditors’ perspective, what was not to like about this arrangement? They got their money back. The people losing their farms, however, understandably felt differently.

In 1786, outrage over the debt crisis triggered some of the most extreme civil unrest the United States has seen. It also sparked uprisings in Vermont, which wasn’t actually part of the United States yet — it wouldn’t become a state for five more years.

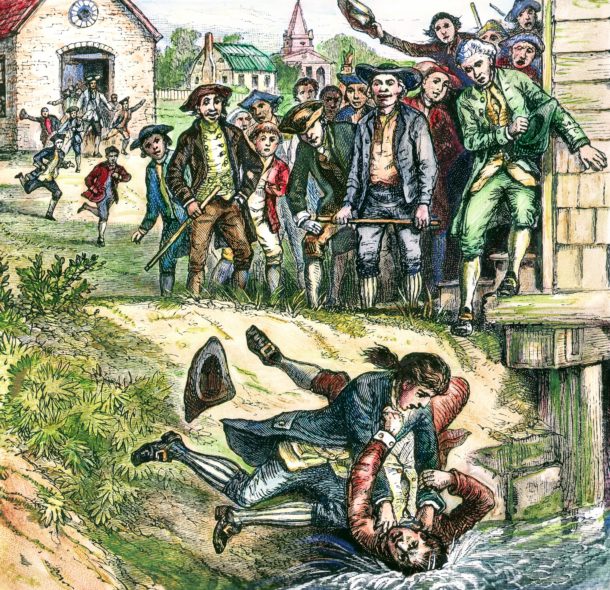

A debtor and a tax collector scuffle outside the courthouse in Springfield, Massachusetts. Indebtedness — and the foreclosures that sometimes followed — became a major issue in the years immediately following the American Revolution. The issue spurred a popular revolt in Massachusetts known as Shays’ Rebellion, as well as a series of physical clashes at Vermont courthouses and verbal clashes in the state Legislature. Wikimedia Commons

A debtor and a tax collector scuffle outside the courthouse in Springfield, Massachusetts. Indebtedness — and the foreclosures that sometimes followed — became a major issue in the years immediately following the American Revolution. The issue spurred a popular revolt in Massachusetts known as Shays’ Rebellion, as well as a series of physical clashes at Vermont courthouses and verbal clashes in the state Legislature. Wikimedia Commons

|

|

01/08/23

|

Legal clinics embody spirit of MLK

|

Newsminer |

Legal clinics embody spirit of MLK

To the editor: If the pandemic has taught us anything it is how much we need each other. Businesses need workers. Children need teachers. The sick need doctors and nurses. Most of us need a professional hairdresser.

And to confront a legal problem — you need an attorney. Regrettably, thousands of Alaskans face legal challenges every year without the resources to hire an attorney or access to limited legal aid. Filling that gap falls to attorneys willing to volunteer their time pro bono.

On Jan. 16, 2023, attorneys across the state will be spending their Martin Luther King, Jr. holiday as “A Day On, Not a Day Off” by volunteering for the fourteenth annual Martin Luther King Jr. Day Legal Clinics.

At these free in-person clinics in Anchorage, Fairbanks, Juneau and Bethel, Alaskans with civil legal problems can expect first come, first serve consultations with an attorney.

|

|

01/07/23

|

CFPB Closes 2022 with $3.7 Billion Consent Order Against National Bank

|

JDSUPRA |

CFPB Closes 2022 with $3.7 Billion Consent Order Against National Bank

Just prior to the close of 2022, the CFPB issued a Consent Order against one of the nation’s largest banks regarding the institution’s automobile loan servicing, mortgage servicing, and consumer deposit account activities dating back to 2011. The Bureau’s Order requires the bank to provide more than $2 billion to consumers harmed by various violations of the CFPA, and a $1.7 billion penalty to be paid to the Bureau’s Civil Penalty Fund.

With respect to mortgage servicing specifically, the Bureau alleged that the bank harmed consumers by improperly denying mortgage loan modification applications and erroneously miscalculating mortgage-related fees and other charges.

|

|

01/06/23

|

Protections against foreclosure abuse in New York approved by Hochul

|

Spectrum Local News |

Protections against foreclosure abuse in New York approved by Hochul

Provisions meant to strengthen protections against abuse in the foreclosure process are set to take effect after Gov. Kathy Hochul's approval of a law addressing a top court ruling lawmakers have argued weakened safeguards for consumers.

|

|

01/06/23

|

How to respond to idiotic non-responses received to QWR, DVL and CFPB complaint

|

Living Lies |

How to respond to idiotic non-responses received to QWR, DVL and CFPB complaint

People often say that using the QWR and DVL is useless because you don’t get any answers. But that is exactly my point. It is like pleading the 5th. In a civil proceeding, the refusal to answer raises any inference implied by the question asked. Whoever you are out there, stop trying to prove something.

|

|

01/05/23

|

After 16 Months, There Are Still No Arrests in the Fed’s Trading Scandal

|

Wall Street On Parade |

After 16 Months, There Are Still No Arrests in the Fed’s Trading Scandal

This coming Saturday will mark the 16-month anniversary of former Wall Street Journal reporter Mike Derby setting off a media firestorm with his reporting that the then President of the Dallas Fed, Robert Kaplan, had “made multiple million-dollar-plus stock trades in 2020,” a year in which Kaplan was a voting member of the Fed’s Federal Open Market Committee (FOMC) with access to inside information.

|

|

01/05/23

|

The case for Continuing Education mandate for public officials

|

Living Lies |

The case for Continuing Education mandate for public officials

Even judges are sent to school before they take the bench. For the last few decades, every catastrophic economic event has been the direct result of the declining use of experts and the politicization of bare-bones facts. It was not malpractice tor repeal the Glass Steagall act or to waive the normal and customary rules governing the issuance of securities when it came to “derivatives” that were so broadly defined that it is difficult to imagine how any security is subject to SEC regulation.

|

|

01/04/23

|

The difference between the debt and the note: the $20 trillion gift to securities brokerage firms on wall street.

|

Living Lies |

The difference between the debt and the note: the $20 trillion gift to securities brokerage firms on wall street.

Why would anyone allow the forced sale of a home to satisfy a claim for that remedy if the claimant had no right to receive any compensation or restitution from the homeowner?

|

|

01/03/23

|

New Consumer Law Rights Taking Effect in 2023

|

NCLC |

New Consumer Law Rights Taking Effect in 2023

CONTENTS

November 17, 2022: Student Loans; Bankruptcy

December 1, 2022: Bankruptcy

December 5, 2022: Arizona Exemptions, Medical Debt

December 15, 2022: HECM Reverse Mortgages

December 27, 2022: Bankruptcy

December 31, 2022: Student Loans; USDA Loan Modifications

January 1, 2023: TILA; FCRA; CLA; HMDA; FHA Loans; Minimum Wage and Wage Garnishment in 27 States; California Various Provisions; District of Columbia Debt Collection; Georgia Retail Crime; Michigan Loans; Nebraska Exemptions; New Mexico Loans; South Dakota Annuities; Virginia Data Privacy

February 15, 2023: Colorado Hospital Collections

March 1, 2023: VA Mortgages

March 10, 2023: Federal Credit Union Interest Rates

March 30, 2023: Reporting of Medical Debt

April 21, 2023: Colorado School Transcripts

June 9, 2023: FTC Safeguards Rule

June 30, 2023: LIBOR

July 1, 2023: Federal Student Loans; VA Mortgages; California Coerced Debt; Colorado Data Privacy; Connecticut Data Privacy; Michigan Property Taxes

July 3, 2023: Alternative Indices for Adjustable-Rate Loans

July 2023: FCC Limits on Robocalls

August 9, 2023: Colorado Homeowner Association Collections

August 29, 2023: Federal Student Loan Payment Pause??

September 1, 2023: TILA Disclosures re Index Rates; California Garnishment; Minnesota Debt Collection

December 1, 2023: Bankruptcy

December 31, 2023: Utah Data Privacy

|

|

01/03/23

|

If you think these pages contain theories and not facts, read the websites of the parties named as “trustees” of “securitized” trusts for “securitized” mortgages

|

Living Lies |

If you think these pages contain theories and not facts, read the websites of the parties named as “trustees” of “securitized” trusts for “securitized” mortgages

This is a zero-sum game, but not in a good way. There is nothing on the side of the grantor and there is nothing on the side of the grantee. The trust, trustee, and servicer have nothing. And the attorney has not heard from or been hired by any of them.

Start with the supposition that all assertions or implications of assertions you are receiving from “servicers” or lawyers who say they present a trust or trustee are all lies.

|

|

01/02/23

|

Don’t allow judicial notice to be an end run around the rules of evidence

|

Living Lies |

Don’t allow judicial notice to be an end run around the rules of evidence

One of the tricks played by lawyers who work for foreclosure mills is to use a motion for the court to take judicial notice of a certain document. While it is usually technically construed only as the document exists, it is practically construed as a memorialization of true facts.

|

|

January | February

| March | April |May

| June |

July | August |

September |

October | November | December

|

|

|

copyright

MSFraud.org

|

A debtor and a tax collector scuffle outside the courthouse in Springfield, Massachusetts. Indebtedness — and the foreclosures that sometimes followed — became a major issue in the years immediately following the American Revolution. The issue spurred a popular revolt in Massachusetts known as Shays’ Rebellion, as well as a series of physical clashes at Vermont courthouses and verbal clashes in the state Legislature. Wikimedia Commons

A debtor and a tax collector scuffle outside the courthouse in Springfield, Massachusetts. Indebtedness — and the foreclosures that sometimes followed — became a major issue in the years immediately following the American Revolution. The issue spurred a popular revolt in Massachusetts known as Shays’ Rebellion, as well as a series of physical clashes at Vermont courthouses and verbal clashes in the state Legislature. Wikimedia Commons